How much joint mortgage can i get

The finances of each co-applicant determine loan approval and loan terms. With joint mortgages youre not just responsible for your half of the loan.

Pin On Commercial And Residential Hard Money Loan In New Jersey

Short Surfer Quiff Hairstyle Source 2.

. Youre agreeing to pay off the whole debt if the other person cant pay. One of the top reasons people apply for a joint mortgage is so they can show more than one income. Now lets imagine your friend or partner also.

If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit. Understand the mortgage two applicants can. Often when looking to buy a new home you may want to buy with someone else.

That means on your own youd probably be able to borrow around 112500 25000 x 45 112500. Entering into a joint mortgage can increase your buying power and give you more freedom when it comes to the price range you can look at. If any borrowers fail to make the repayments the mortgage provider has to bear a significant loss.

Free advice on joint mortgages and joint. A lot of people have questions about joint mortgages such as who can get a joint mortgage. It is the reason that all the partners should get the responsibility that they can afford to.

In the case of a joint mortgage theres more than one set of applicant information. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income. 22 Long Hair Ideas For Men 2022 Trends Styles Long Hair Sty.

This mortgage calculator will show how much you can afford. Or how much can I borrow with a joint mortgage. But ultimately its down to the individual lender to decide.

Under current lending regulations you can even jointly buy a house with the support of. In this post we go into all the details of joint. For joint mortgages the lender analyzes the information for all parties.

28102021 Estimated Reading Time. Two or more parties who agree to buy a home can be co-borrowers and enter into a joint mortgage arrangement as long as all parties are over the age of 18 and the mortgage. Lenders will look at the income and assets for all.

Youre both liable for any joint debt. Our Two Person Mortgage Qualification Calculator provides the following key outputs. If the same person applied for a joint mortgage.

You can co-finance a house through a lender with one or both parents. Lets say you earn 25000 per year. The first step in buying a house is determining your budget.

As part of an. Your salary will have a big impact on the amount you can borrow for a mortgage. Using the 35 - 45x cap as an example a sole applicant earning 35000 may be offered a mortgage of 122500 - 157500 respectively.

A joint mortgage is a mortgage multiple parties obtain together. For example lets say the borrowers salary is 30k. All of the parties on the joint mortgage.

415 74 votes. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. The Best Companies All In 1 Place.

Fill in the entry fields and click on the View Report button to see a. Estimated Mortgage Amount Two People Qualify For.

Why Buy Real Estate Investing Home Buying Home Ownership

Pin On Bragit Design Social Media Posts

Mortgage Calculator How Much House Can I Afford

Mortgage Monkey Flyer Estateagent Property Lifeofanagent Mortgage Marketing Reverse Mortgage Mortgage

Budgeting For Couples How To Budget As A Couple Budgeting Debt Solutions Money Management Advice

Invismitweets Making It Happen With The Anatomy Of A Mortgagebroker Mortgage Brokers Mortgage Interest Mortgage Lenders

How Much Does A Loan Modification Affect Your Credit Score Loan Modification Divorce Lawyers Divorce Attorney

Buying Vs Renting Doing The Math On What S Best For You Compass Mortgage

Joint And Mutual Will Resignation Letters Resignation Letter Free Printables

It S Imperative You Work Out Your Requirements And Wants Well In Advance Before You Decide To Rent Or Buy Buying First Home First Time Home Buyers Real Estate

29 Ways It Pays To Work With A Realtor Real Estate Finance Blog Real Estate Buying

Homebuying Vs Renting A Cost Comparison 30 Year Mortgage Mortgage Payment Rent

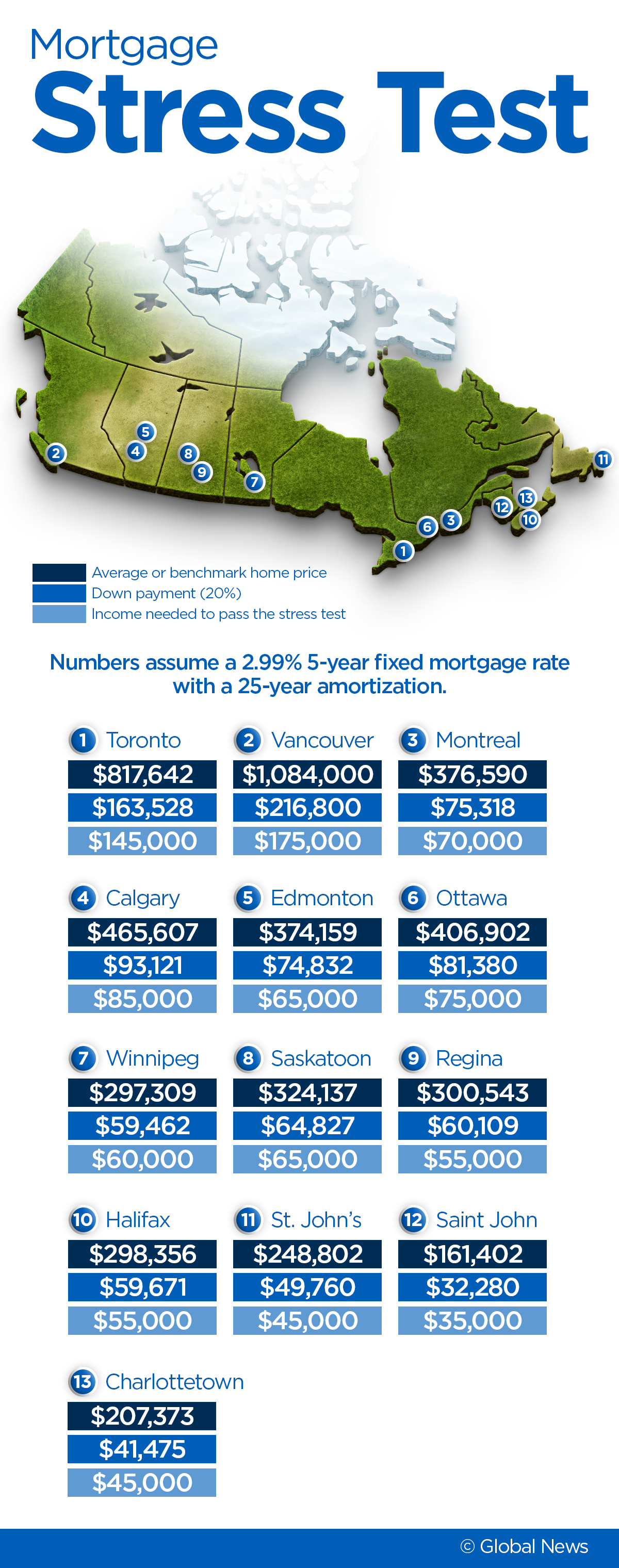

Here S The Income You Need To Pass The Mortgage Stress Test Across Canada National Globalnews Ca

How We Paid Off 340 000 Mortgage In 3 Years By Saving 86 5 Of Our Income Hishermoneyguide Dr Breathe Easy Finance Debt Free Money Saving Tips Money Management

See Our Reassured Infographic Displaying The Key Differences Between Level And Decreasing Term Lif Life Insurance Facts Best Life Insurance Companies Term Life

![]()

Pros And Cons Of Joint Mortgages Loans Canada

29 Ways It Pays To Work With A Realtor Buying A Home Pre Qualifying Where To Start Real Estate Real Estate Tips Real Estate Infographic Real Estate Advice